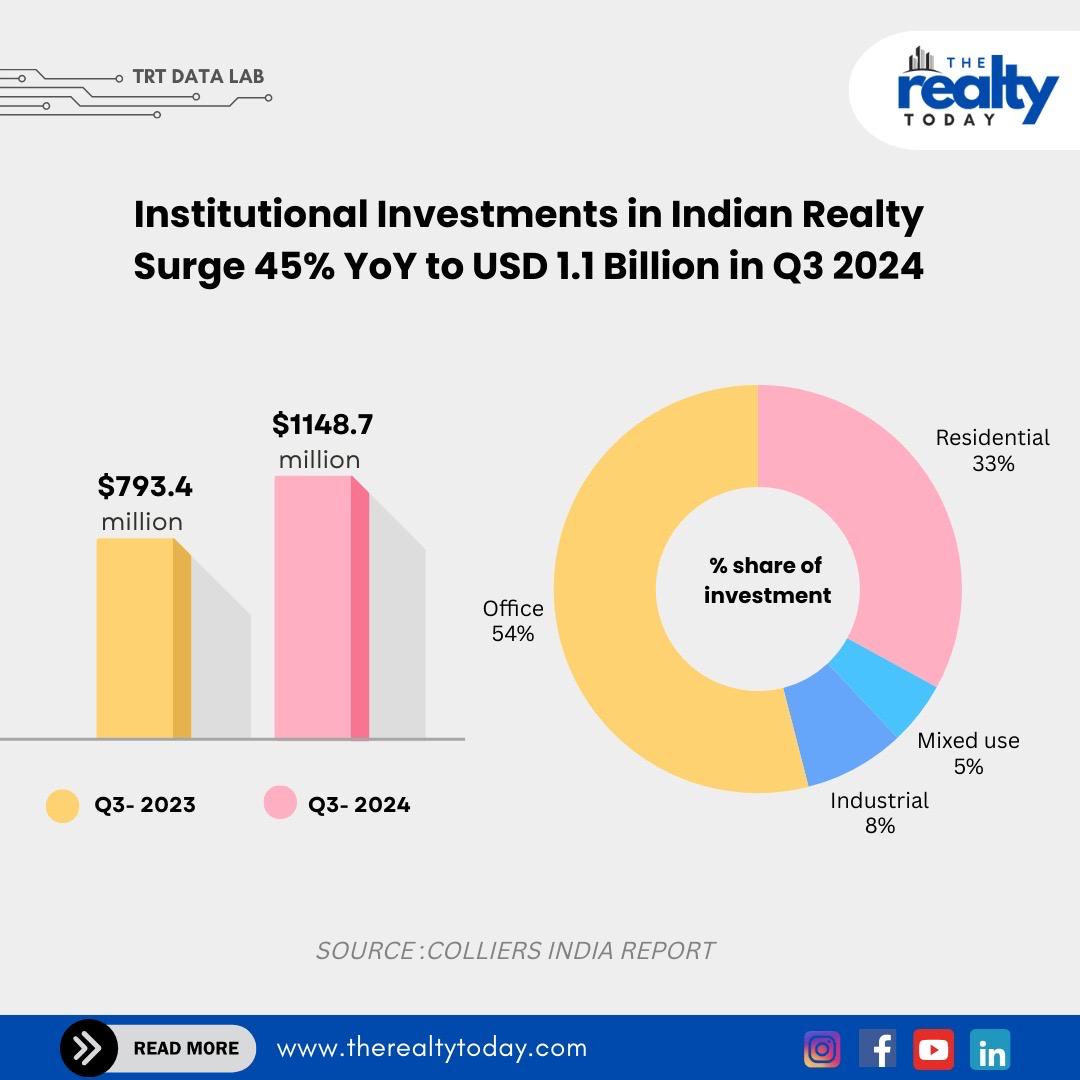

Institutional investments in India's real estate sector reached USD 4.7 billion during the first nine months of 2024, nearly matching the same period in 2023. Q3 2024 alone saw investments of USD 1.1 billion, marking a 45% year-on-year growth. The office segment led with 54% of total investments, while the residential segment captured 33%, driven largely by domestic capital. Domestic investments remained strong at USD 0.5 billion, making up 44% of the total quarterly inflows. Foreign investments also surged, with USD 0.6 billion inflows in Q3 2024, more than doubling compared to the same period last year. Significant focus was placed on office and residential assets, with new investment opportunities emerging in fractional ownership, flexible credit, and hospitality.

Key markets like Chennai and Mumbai accounted for 57% of total quarterly inflows, mainly from foreign investments in the office segment. Residential investments saw a 40% year-on-year growth in Q3 2024, driven by private equity and partnerships with developers on marquee projects. With strong investor confidence, driven by a robust Grade A office supply, homeownership trends, and anticipated reductions in interest rates, the real estate sector is expected to end 2024 on a strong note, likely surpassing the previous year’s investment volumes.

.png)