Key highlights for the House of Hiranandani co-working launch:

- New Business Entry: House of Hiranandani has entered the flexible office space segment with a pilot co-working centre at Hiranandani Gardens, Powai, offering 160 seats.

- Scalable Model: The Powai facility has the capacity to expand to 500 seats, with future co-working centres planned across Andheri and Thane after performance assessment.

- Strategic Utilisation: The pilot leverages vacant prime commercial space, marking a shift from traditional leasing to flex-office operations.

- Commercial Growth Push: The launch aligns with HoH’s broader commercial strategy, including a ₹500 crore investment in a 4 lakh sq ft office project in Andheri East.

Mumbai-based real estate developer House of Hiranandani (HoH) has entered the flexible office space segment with the launch of a pilot co-working project at Hiranandani Gardens in Powai. According to company sources, the initial facility offers 160 seats and marks the group’s first foray into the rapidly expanding flex office market.

The Powai property has the potential to accommodate up to 500 seats in total; however, the developer has opted to begin operations with a smaller pilot phase to assess demand and operational dynamics. Sources said the company plans to evaluate performance before scaling up the offering.

“Going further, HoH will explore adding more properties of the company for the co-working space business, including those in Andheri and Thane,” the sources said.

Providing insight into the thinking behind the new business line, Ankit Mathur, Senior Manager, Commercial Business, House of Hiranandani, shared details in a recent LinkedIn post. “A few months ago, my MD called me to discuss the start of a new business line in flex offices. We had some empty space available in the prime locality and we wanted to do little differently with that space rather than giving it on lease as our standard business. We decided to start the pilot project of our coworking Centre from Hiranandani Garden, Powai,” Mathur said.

He further outlined the execution journey of the project, noting, “Then came the real stuff, layouts, budgets, service partners, legal work, compliances, procurement lists that grew longer every day, and late-night debates about which theme to choose. Gradually the space began to take shape. Today it's a very proud moment for all of us that our first centre is operational and our first client has commenced their operations.”

The decision also coincides with the time when House of Hiranandani is aggressively growing its commercial real estate presence. Last October, the developer had made a public declaration of its plans to pump in 500 crore to a commercial project after obtaining a land parcel of one acre in Andheri East, Mumbai. The project that is now under construction is anticipated to have around 4 lakh sq feet of leasable office space.

At the moment, House of Hiranandani holds nearly 7 million sq ft of office space in the Mumbai Metropolitan Region. The developer has so far delivered more than 50 million sq ft of built, up area and 26, 612 homes have been completed.

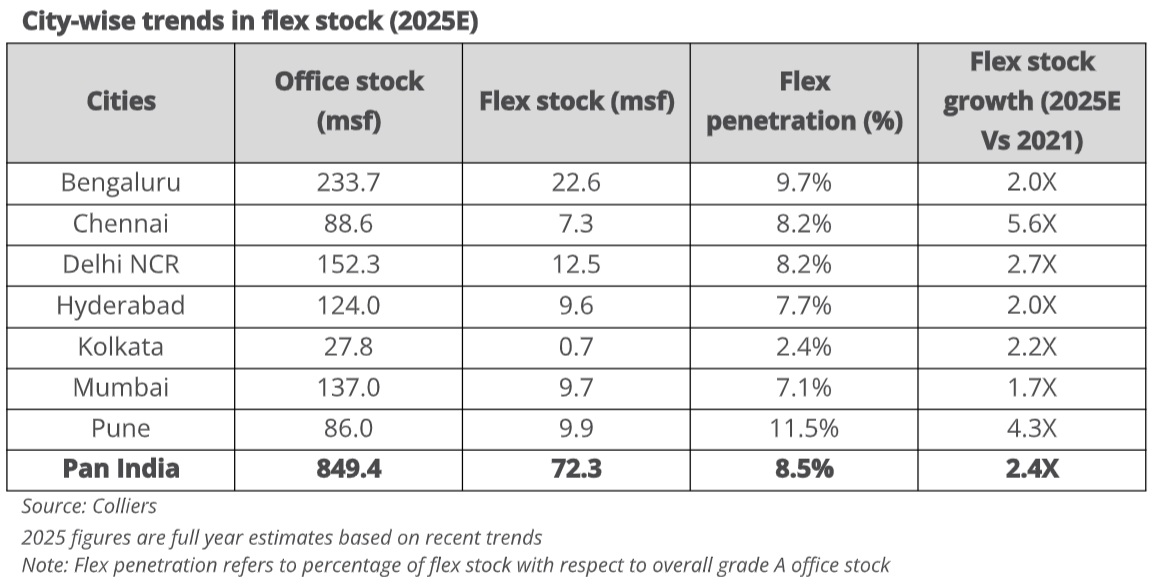

India’s flex office space segment continues to witness strong growth. According to Colliers’ December 2025 report Flex India: Pioneering the Future of Work, the segment is expected to cross 100 million sq ft by 2027, up from 72.3 million sq ft in 2025. Bengaluru leads the market with a 31% share, while Pune records the highest penetration at 11.5%, driven in part by rising demand from Global Capability Centres (GCCs).

The share of flex spaces in the overall office stock is also set to strengthen, with flex penetration likely to rise from 8.5% in 2025 to 10.5% by 2027, supported by sustained operator expansion. This growth will be further fueled by strong enterprise demand, with average annual seat uptake projected to increase 25% over the next two years to around 200,000 seats, compared to 160,000 seats seen during 2024 and 2025.

.png)