Key highlights of the BA Continuum Powai lease:

- Lease Details: BA Continuum India leased 1.11 lakh sq. ft. in Powai’s Cignus Building for ₹1.43 crore/month, effective Jan 1, 2026.

- Floors & Parking: Occupies 22nd and 23rd floors with 112 car parking spaces.

- Rental Terms: ₹129/sq ft basic rent, ₹20/sq ft CAM, ₹8.59 crore security deposit, 15% rent escalation from Oct 2027 every 3 years.

- Strategic Appeal: Powai preferred by MNCs in IT, BFSI, and consulting, with excellent connectivity via Eastern Express Highway, JV Link Road, and Mumbai Airport.

- Market Context: Powai is a high-demand corporate hub, supporting flexible office formats, large corporate floors, and attracting domestic & multinational tenants.

In a major deal in the commercial realty sector of the Mumbai market, BA Continuum India Private Limited, a subsidiary of Bank of America, leased 1.11 lakh sq. ft. of office space in the Powai area for a rent of about Rs. 1.43 crore a month. This deal underlines the increasing popularity of the area of Powai as one of the favorite locations in the Mumbai market for office spaces.

As per the property registration papers accessed by CRE Matrix, the lease transaction was conducted with Chalet Hotels Limited for the office space available in the Cignus building, which is located in Passpoli, Powai.

In this commercial high-rise building, office space is available in the 22nd and 23rd floors, and the registered lease agreement is dated December 24, 2025, and effective from January 1, 2026. The major terms and conditions in the agreement are as follows: the basic rent paid is ₹129 per sq ft, Common Area Maintenance charge per sq ft is ₹20, the security deposit to be paid is ₹8.59 crore, and there are 112 car parking spaces available. Additionally, there is a rent escalation of 15% from October 1, 2027, and after every three years.

This lease agreement is all about the preferred location of Powai for MNCs in the IT and BFSI and the consulting and Capability Centers domain. It is strategically located in the vicinity of the Eastern Express Highway and the Jogeshwari-Vikhroli Link Road and has easy accessibility to the international airport at Mumbai. This makes it a preferred location for corporate space. Along with this, there is a presence of residences in the area and have a completely developed commercial setup wherein companies can be brought together at one single platform.

Recent high, value office leases in Powai:

JP Morgan Services India Private Limited

- Leased more than 2.71 lakh sq ft at One Downtown Central (former CRISIL House)

- Lease term: 5 years

- Total rental value: 612 crore

CRISIL Limited

- Leased around 2.5 lakh sq ft at Hiranandani Lightbridge, Saki Vihar

- Lease term: 15 years

- Total rental value: 597 crore

Such deals are proof of the growing need for large, modern office spaces in different micro markets of Mumbai. Corporates are gradually looking for places that offer a good combination of accessibility, infrastructure, and employee lifestyle amenities. Powai, especially, has become a place for flexible office formats and big corporate floors serving the needs of both domestic and multinational companies.

According to experts from the industry, a blend of competitive rentals, strategic location, and quality office infrastructure is what makes Powai one of the most resilient office markets in Mumbai. While a number of high-profile leases are getting executed-featuring the recent deal by BA Continuum India-the micro-market is all set to lead unabated, therefore attracting both technology and financial sector players who are on the prowl for long-term office commitments.

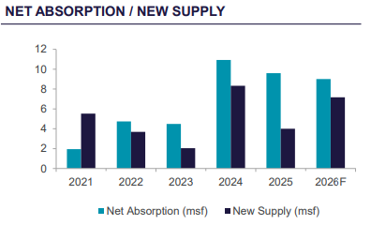

According to the Cushman & Wakefield report, in Q4 2025, Mumbai's office Gross Leasing Volumes (GLV) were 4.3 MSF, led by leasing volumes from flexible workspace operators, who contributed approximately 38% to overall leasing volumes. Contributions from the BFSI & Engineering & Manufacturing sectors accounted for about 12% each. The growing presence of flexible workspace operators is catalyzed by increasing corporate requirements for flexible, affordable, & hybrid workspace solutions. New leasing volumes with 2.7 MSF were also strong, accounting for 62% of overall Gross Leasing Volumes during the quarter.

Demand trends during the quarter were skewed with the Central Suburbs recording the most leasing activity with 1.0 msf of space leased, or 24% of overall leasing volumes. Andheri-Kurla Rd & Lower Parel followed as the next most resilient micro markets with contributions of roughly 15% & 14%, respectively. Overall leasing volumes during 2025 stood at 16.9 MSF with leaders such as BFSI at 28%, Flexible Workspaces at 18%, & IT-BPM at 15%.

While Mumbai's commercial real estate landscape is evolving, Powai is mooted not only for its corporate appeal but also as a barometer of market trends. The sustained demand from global and domestic players cements the city's position as India's financial and business capital, which has the preparedness to sustain large-scale, high-value office leasing transactions for many years to come.

.png)