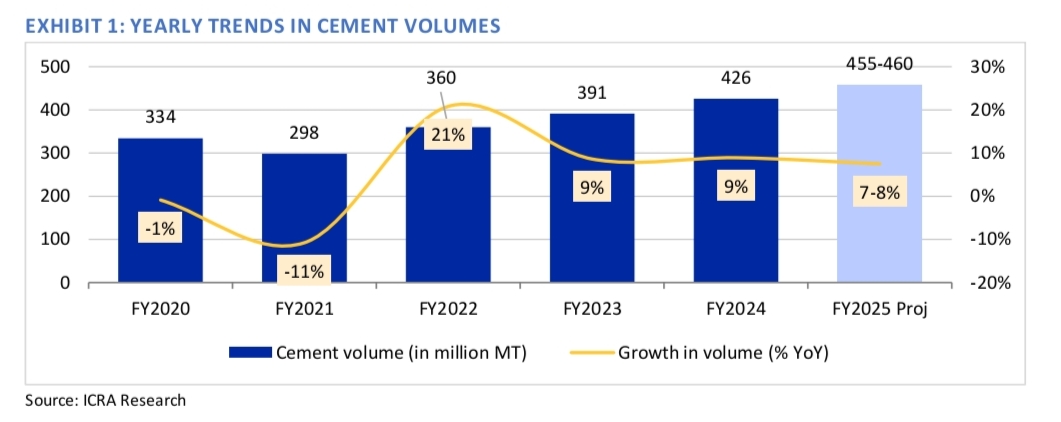

The cement industry is projected to see a subdued growth rate of 2-3% in cement volumes for the first quarter of the fiscal year 2024-25, according to a recent report by ICRA. This moderate growth is attributed to a temporary slowdown in construction activities during the General Elections period. Despite this, the outlook for the remainder of the fiscal year remains positive, driven by a robust pipeline of infrastructure projects and increased housing and industrial capital expenditure.

Current Market Conditions

In the June quarter of 2024, cement volume growth is expected to be relatively muted due to the reduced pace of construction activities caused by the General Elections. This period has traditionally seen slower development work as political uncertainties and pre-election adjustments impact project timelines. However, this slowdown is expected to be a short-term phenomenon, with significant improvements anticipated in the latter half of the fiscal year.

Anupama Reddy, Vice President at ICRA, highlighted that the operating income for cement companies is forecasted to increase by 7-8% year-over-year for the fiscal year 2024-25. This anticipated growth is primarily driven by expected increases in volume and sustained pricing levels. The demand for cement is projected to rise significantly in the latter half of the fiscal year due to a combination of government-led infrastructure initiatives, increased allocations under the Pradhan Mantri Awas Yojana (PMAY), and a general upturn in industrial capital expenditure.

Government Initiatives and Their Impact

The Indian government’s focus on large-scale infrastructure projects is set to be a major driver of cement demand in the upcoming months. Key initiatives include the construction of roads, bridges, and public buildings, as well as the expansion of urban infrastructure under various government schemes. Additionally, the sanctioning of new housing projects under the PMAY is expected to contribute to increased cement consumption. This scheme aims to provide affordable housing to the urban poor, thereby stimulating demand for building materials.

Financial Projections for FY25

ICRA's report also forecasts that cement companies will see an increase in operating income due to a combination of higher volumes and a slight increase in profitability. Cement prices are expected to hold steady compared to the previous fiscal year, although cost pressures, particularly from power and fuel, may exert some influence. The report projects a modest 3% increase in the operating profit before interest, tax, depreciation, and amortization (OPBITDA), bringing the expected range to ₹975-1,000 per tonne.

Sustainability and Green Initiatives

A significant trend in the cement industry is the shift towards sustainability. Major cement players are working towards reducing carbon emissions and increasing the use of green power. The share of green power in the total energy mix for the sector is expected to rise to 40-42% by the end of FY24, up from 35% in FY23. This increase is part of a broader strategy to reduce emissions by 15-17% over the next 8-10 years through the adoption of blended cements and investments in renewable energy sources such as solar and wind power.

Capacity Expansion and Regional Growth

Looking ahead, the cement industry is poised for substantial capacity expansions. ICRA forecasts a total addition of 63-70 million tonnes of cement capacity by FY26, with approximately 33-35 million tonnes expected to come online in the current fiscal year. The majority of this new capacity is set to be concentrated in the eastern and southern regions of India, which are expected to see the most significant growth. As a result, the capacity utilization rate is anticipated to improve from 70% in FY24 to 71% in FY25, reflecting increased demand for cement.

Market Share Dynamics

ICRA estimates that the market share of the top five cement companies witnessed a steep rise to 54% as of March 2024 from 45% as of March 2015, and projects it to further increase to 58-59% by March 2026, resulting in consolidation in the cement industry.

Conclusion

While the cement industry faces a period of slow growth in the first quarter of FY25 due to election-related delays, the overall outlook for the year remains strong. Government infrastructure projects, housing schemes, and increased capital expenditures are expected to drive substantial growth in cement demand during the latter half of the fiscal year. Additionally, the industry’s focus on sustainability and green power initiatives positions it for long-term growth and resilience in the face of evolving market conditions.

Image source- pixabay.com

.png)