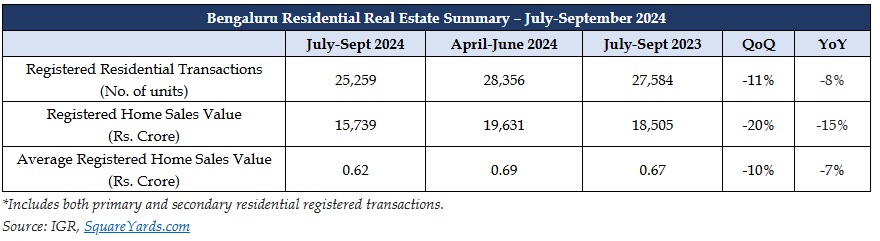

In the July-September 2024 quarter, Bengaluru’s residential market saw the registration of 25,259 units, including both apartments and plots, with the Inspector General of Registration (IGR), according to Square Yards data. This represents a modest year-on-year decrease of 8% compared to the same period in 2023. The total transaction value for these registrations reached Rs. 15,739 crore, a 15% drop from Rs. 18,505 crore in the corresponding quarter of the previous year. Consequently, the city’s average home sale price recorded a 7% annual decrease, bringing the current average to Rs. 62 lakh.

“Bengaluru's residential market has seen a modest moderation in transaction momentum in the July-September 2024 quarter, a natural adjustment following a period of rapid growth”, said Sopan Gupta, Principal Partner, Square Yards. “During the festive season, we've seen heightened homebuyer interest, and as registrations generally complete within three to six months post-booking, we anticipate this demand to manifest in the upcoming quarters. Interest remains strong across both apartments and plots, with the northern micro-market gaining traction in particular. Looking ahead, we expect demand to continue on an upward trajectory, driven by resilient end-user and investor appetite. Ongoing infrastructure development, such as expansion of metro network and tech-infrastructure coupled with heightened office space uptake from major global tech players, are set to positively trickle in residential market in Bengaluru,” he added.

Market Leaders and Key Projects

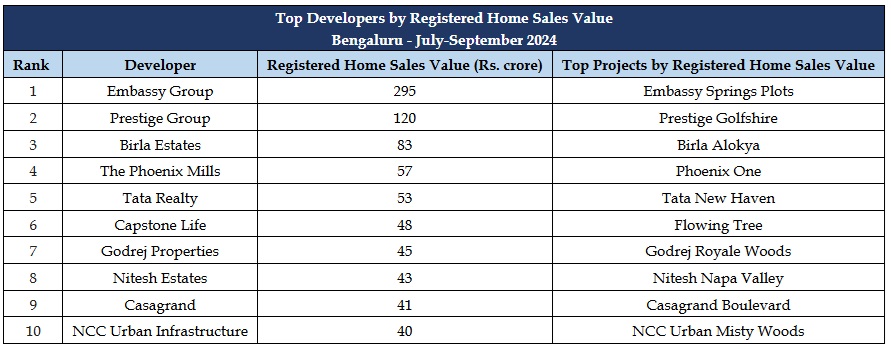

Among developers, Embassy Group led with the highest home sales value, reaching Rs. 295 crore. Their projects, Embassy Springs, a residential plotted project in Devanahalli, and Embassy Lake Terraces, an residential apartment project, in Hebbal, emerged as the top projects in terms of sales value. Close behind was Prestige Group, with Prestige Golfshire leading in sales value among its projects in July-September 2024 period.

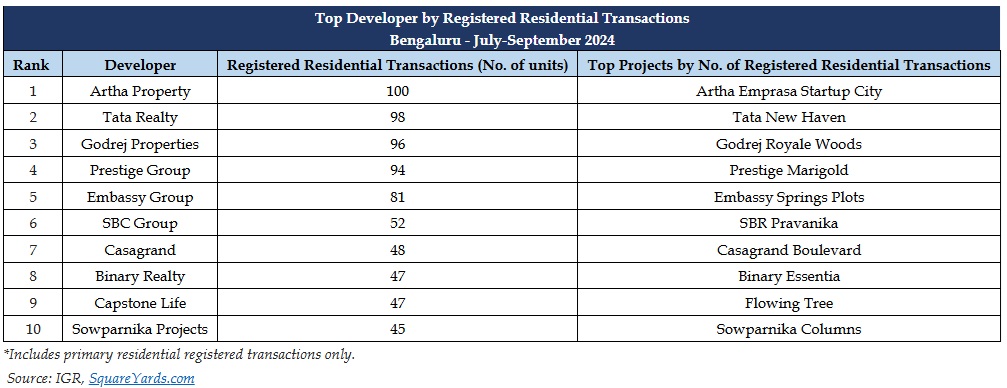

In terms of transaction volume, Artha Property and Tata Realty held the lead. Artha Emprasa Startup City in Hoskote recorded the highest number of transactions in the September 2024 quarter, with Tata Realty’s New Haven coming in as a close second in Bengaluru. Both Birla Estates and Godrej Properties also made notable contributions, registering significant home sales values and transaction volumes, respectively.

Area & Budget-wise Trends

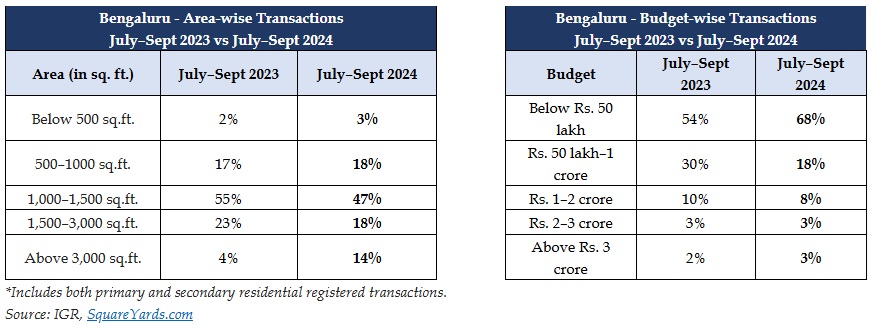

In July-September 2024 quarter, the majority (86%) of property transactions in Bengaluru were concentrated in the price bracket below INR 1 crore. The remaining transactions were in the INR 1 crore and above category, with a notable 8% in the INR 1-2 crore range. Apartments ranging from 1,000 to 1,500 sq. ft. accounted for the largest share of transactions at 47% of the 25,259 total registrations. This trend indicates a continued preference for larger living spaces, driven by the adoption of hybrid work models in IT/ITes sectors, which have influenced post-pandemic housing demand in the city.

Micro Market Performance

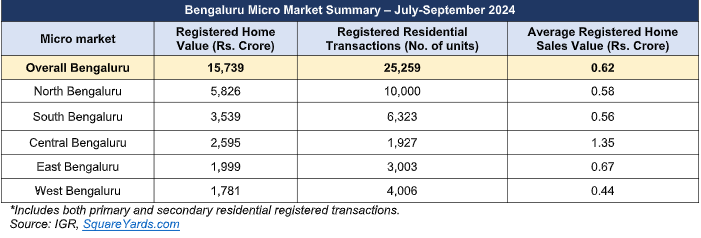

Bengaluru's micro-market trends indicate that North Bengaluru remains the city's most active region, accounting for 40% of registered transactions during the September 2024 quarter. The micro-market’s proximity to Kempegowda International Airport has driven increased demand, particularly for plot acquisitions. Localities such as Chikkasanne and Chikkasandra, led activity within the northern micro-market. South Bengaluru followed closely with a 25% share of total transactions, with Jayanagar and Electronic City standing out as key localities. Notably, Jayanagar recorded the highest home sales value in Bengaluru, totalling Rs. 469 crore, while Krishnarajapuram led in transaction volume, with 192 units sold during the quarte.

Central Bengaluru remains the most expensive micro-market in the city, with an average home sales value of Rs. 1.35 crore during the September quarter. The Eastern micro-market followed, with an average sales value of Rs. 67 lakh. In contrast, Western Bengaluru continues to offer relatively affordable options, with an average transaction value of Rs. 44 lakh.

Bengaluru’s residential market has grown steadily since the pandemic, with recent figures showing a moderate slowdown after a period of rapid expansion. The city is also benefiting from infrastructure improvements, such as metro expansion and the development of 89 new tech parks. These enhancements are expected to support ongoing growth and enhance livability, potentially increasing interest in the residential market.

Image source- freepik.com

.png)