Property owners in Bengaluru have been urged to clear their outstanding tax dues before March 31, as the Bruhat Bengaluru Mahanagara Palike (BBMP) has announced stringent penalties for defaulters starting April 1. Munish Moudgil, BBMP’s special commissioner for revenue, has instructed officials to intensify efforts to collect the remaining property tax before the conclusion of the 2024-25 financial year.

BBMP’s Property Tax Collection Target

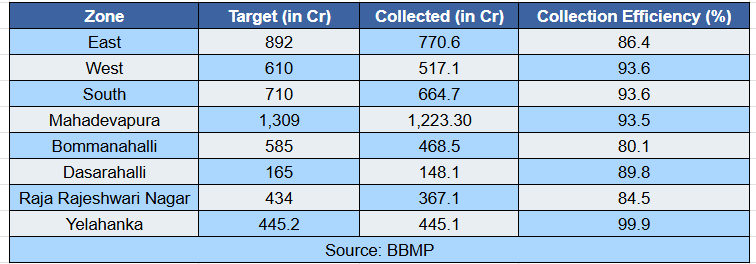

For the financial year 2024-25, BBMP set a collection target of Rs 5,200 crore in property taxes. As of now, the civic body has managed to collect Rs 4,604 crore, covering approximately 88.4% of the target. Some zones, like Yelahanka, have performed exceptionally well, reporting nearly 100% tax collection against their Rs 445 crore target. However, other zones still have significant pending dues.

To bridge this gap, BBMP has intensified measures to recover the outstanding amounts from property owners. Officials have been directed to visit businesses and establishments with high pending tax dues and ensure immediate collection.

Stricter Penalties and Higher Interest Rates

From April 1, property owners failing to clear their dues will face a 100% penalty on the pending tax amount. The Karnataka government had amended the BBMP Act in the previous year, reducing the penalty for tax arrears from double the due amount to an equal amount. A temporary relaxation had also been provided, capping the penalty at Rs 100 per Rs 100 of unpaid tax for one year. However, this relaxation is set to expire on March 31, making it crucial for property owners to settle their dues before the deadline.

Additionally, defaulters will have to bear an annual interest charge on their unpaid taxes. Any outstanding tax from 2022-23 or earlier will accrue a 9% interest rate, while dues from 2023-24 will attract a 15% interest rate. For unpaid taxes from the new financial year (2024-25), a 15% annual interest will also be applicable. For instance, if a property owner has Rs 1,000 pending from 2022-23, they will need to pay Rs 2,000, along with an additional 9% interest.

High Number of Defaulters in Certain Zones

BBMP has identified approximately 1,82,467 properties within its jurisdiction that have pending tax dues. The highest concentration of defaulters has been reported in Mahadevapura, East, and South zones, where tax collection efficiency has lagged compared to other areas.

A breakdown of tax collection efficiency across various zones reveals disparities in payment compliance.

BBMP’s Measures to Ensure Compliance

BBMP officials have already begun taking legal action against defaulters. Measures such as seizing and auctioning properties to recover unpaid taxes are being considered. The civic body has emphasized that all pending property tax dues will be treated under the same penalty structure, irrespective of whether the delay was due to late payments or misdeclaration of property details.

“We have been taking stringent action against defaulters, including seizing and auctioning properties to recover unpaid tax,” said a senior BBMP official. “From April 1, any pending property tax will attract a 100% penalty. With the March 31 deadline approaching, we urge property owners to clear their dues immediately to avoid paying double the amount.”

Final Call for Property Owners

With strict penalties and high interest rates looming, property owners are advised to act swiftly and clear their tax dues before the March 31 deadline. Failing to do so could result in significant financial burdens and legal action from BBMP. The civic body’s intensified efforts reflect a determined push to maximize tax compliance and boost Bengaluru’s municipal revenue for the upcoming fiscal year.

.png)