Bakeri Group, one of the oldest and leading real estate developers, and Lumos Alternate, a prominent investment management firm, today announced the launch of a ₹500 crore real estate investment platform, “Sakar Realty Fund - I.”

The platform recently received final approval from SEBI and aims to provide superior returns to its investors by leveraging the exceptional execution capabilities of Bakeri Group, which has delivered more than 42 million sq. ft. of real estate development over its 65-year legacy.

Platform deals are quite common among institutional investors, and in recent years, more than ₹20,000 crore has been committed by institutions to some of India's most reputed developers. However, retail investors and family offices generally don’t have direct access to such deals. Sakar Realty Fund - I aims to facilitate and expand access to institutional-grade investments by providing a regulated investment vehicle that allows investors to participate in high-quality real estate projects.

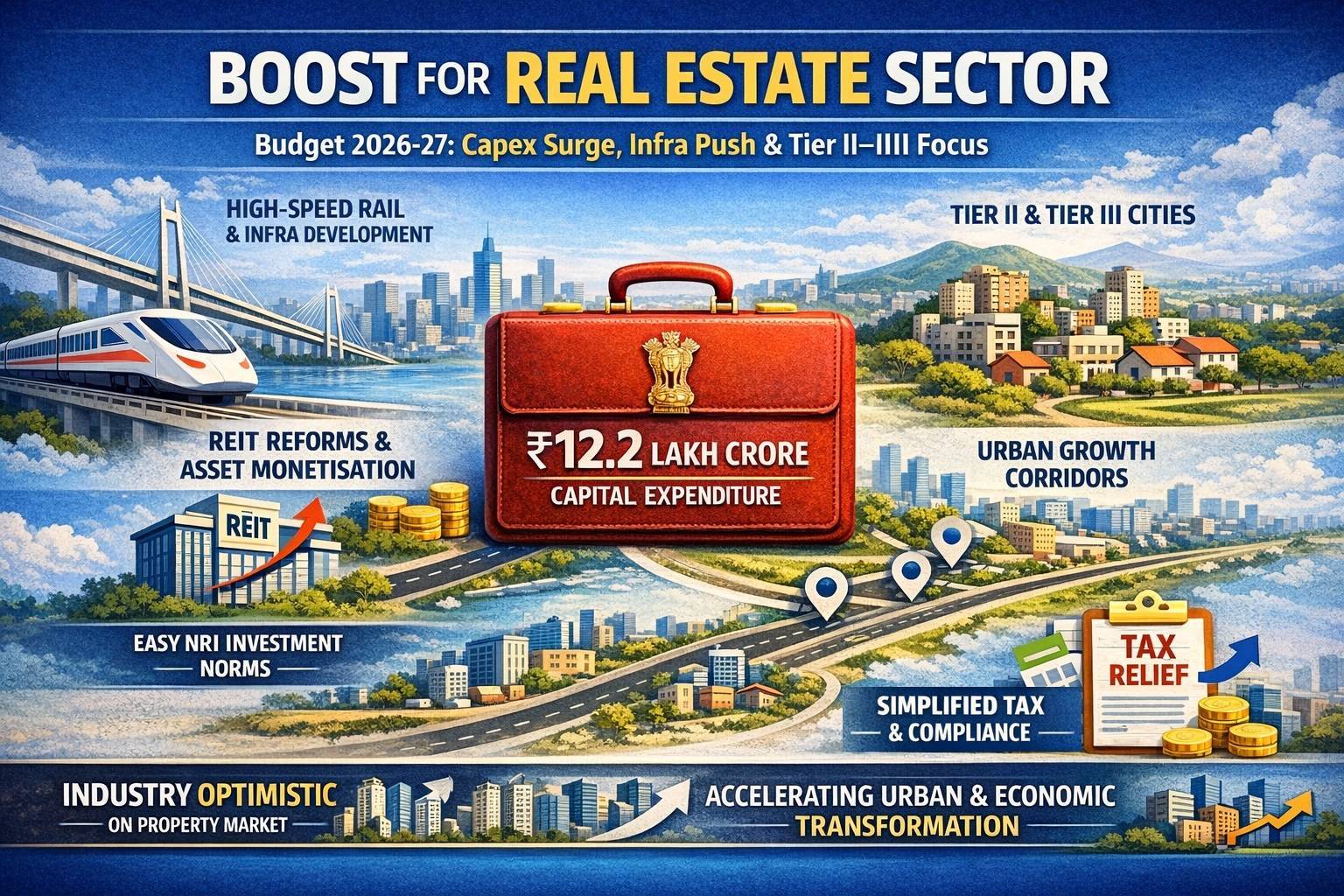

Commenting on the platform, Mr. Anuranjan Mohnot, Managing Director and CEO of Lumos Equity Advisors Private Limited, said, “The real estate market has been robust over the past few years, and many family offices and HNIs are looking to establish long-term direct partnerships with credible real estate developers who have successfully navigated multiple real estate cycles. Sakar Realty Fund, provides investors the opportunity to partner with one of the most trusted and experienced developers at an early stage and on pre-defined terms. The platform will invest in mid-market residential projects in Bangalore, Mumbai, Ahmedabad, and Pune, with an investment horizon of 3-4 years per project.”

He further added, “A pre-structured deal with a credible developer creates a win-win situation for both investors and developers. While the developer gains confidence in the availability of equity on call, investors benefit from a well-defined corporate governance framework and return structure with their preferred developer. Additional comfort is provided by an independent asset management company and investment committee, which ensures rigorous monitoring and timely enforceability of contracts.”

Mr. Pavan Bakeri, Promoter and Managing Director of Bakeri Group, stated, “The real estate industry is expected to grow from its current size of approximately $500 billion to $1.5 trillion by 2034. This expansion presents significant and sustainable opportunities for developers and investors to participate in and benefit from India’s growth story. The Sakar Realty Fund uniquely blends development expertise with independent investment acumen, delivering value to investors while contributing to landmark real estate projects in major Indian cities.”

Sakar Realty Fund - I offers a structured investment opportunity, bringing together trusted development expertise and strong governance for HNIs, family offices, and institutions.

Image source-lumosaif.com, bakerigroup

.png)