Adani Group is in advanced discussions to expand his real estate portfolio with a potential acquisition of the Indian unit of Dubai-based developer Emaar Properties. The deal, valued at approximately $1.4 billion (₹12,090 crore), would mark a significant step in Adani Group’s real estate ambitions.

According to the DNA report,sources familiar with the matter, discussions between Adani Group and Emaar Properties are ongoing regarding the structure of the transaction. One possible arrangement under consideration involves an unlisted Adani entity infusing around $400 million in equity. While negotiations are in advanced stages, a final agreement could be reached as early as April 2025. However, sources have cautioned that there is no certainty of a deal being finalized as talks continue. Both Adani Group and Emaar Properties have declined to comment on the reports.

Adani’s Growing Footprint in Real Estate

The Adani Group is already active in the real estate sector through its unlisted arms Adani Realty and Adani Properties. The company has been involved in the development of multiple residential and commercial projects across key metropolitan cities in India.

One of Adani’s largest real estate projects includes the redevelopment of Dharavi, one of Asia’s biggest slums, in Mumbai. The group secured this project with a ₹5,069 crore bid in 2022 and is expected to spearhead a large-scale urban transformation initiative.

Additionally, Adani Realty won the highest bid for the ₹36,000 crore redevelopment of Motilal Nagar in Mumbai, further solidifying its role in large-scale infrastructure and real estate projects. The potential acquisition of Emaar India would significantly bolster Adani Group’s real estate holdings and position it as a major player in the sector.

Emaar’s Journey in India

Emaar Properties entered the Indian real estate market in 2005 through a joint venture with MGF Development, an Indian real estate firm. Over the years, the joint venture, Emaar MGF Land, invested around ₹8,500 crore into the Indian real estate sector, developing large residential and commercial properties.

In April 2016, Emaar Properties decided to exit the partnership and initiated a demerger process to separate its operations from MGF Development. Since then, Emaar India has focused on expanding its portfolio, with projects in Delhi-NCR, Mumbai, Mohali, Lucknow, Indore, and Jaipur. The company has delivered numerous high-end residential developments, office spaces, and retail centers across these locations.

Why the Deal Matters?

If finalized, this deal would be one of the largest transactions in India’s real estate sector in recent years. The acquisition would not only give Adani Group access to Emaar India’s extensive land bank and ongoing projects but also strengthen its foothold in the premium residential and commercial real estate segments.

For Emaar, exiting India would align with its broader strategy of focusing on its core markets in the Middle East and North Africa (MENA) region. The company has been strategically consolidating its operations and streamlining its business portfolio.

Gautam Adani’s Business Expansion Strategy

At 62 years old, Gautam Adani continues to expand his business empire across multiple sectors, including infrastructure, power, renewable energy, logistics, and real estate. His real-time net worth stands at $59.3 billion, according to Forbes, making him one of the richest individuals in India.

The Adani Group has been aggressively expanding its footprint through acquisitions and strategic investments. In addition to large-scale real estate projects, the group has also entered data centers, airports, and green energy ventures, signaling its broader interest in urban infrastructure and sustainability.

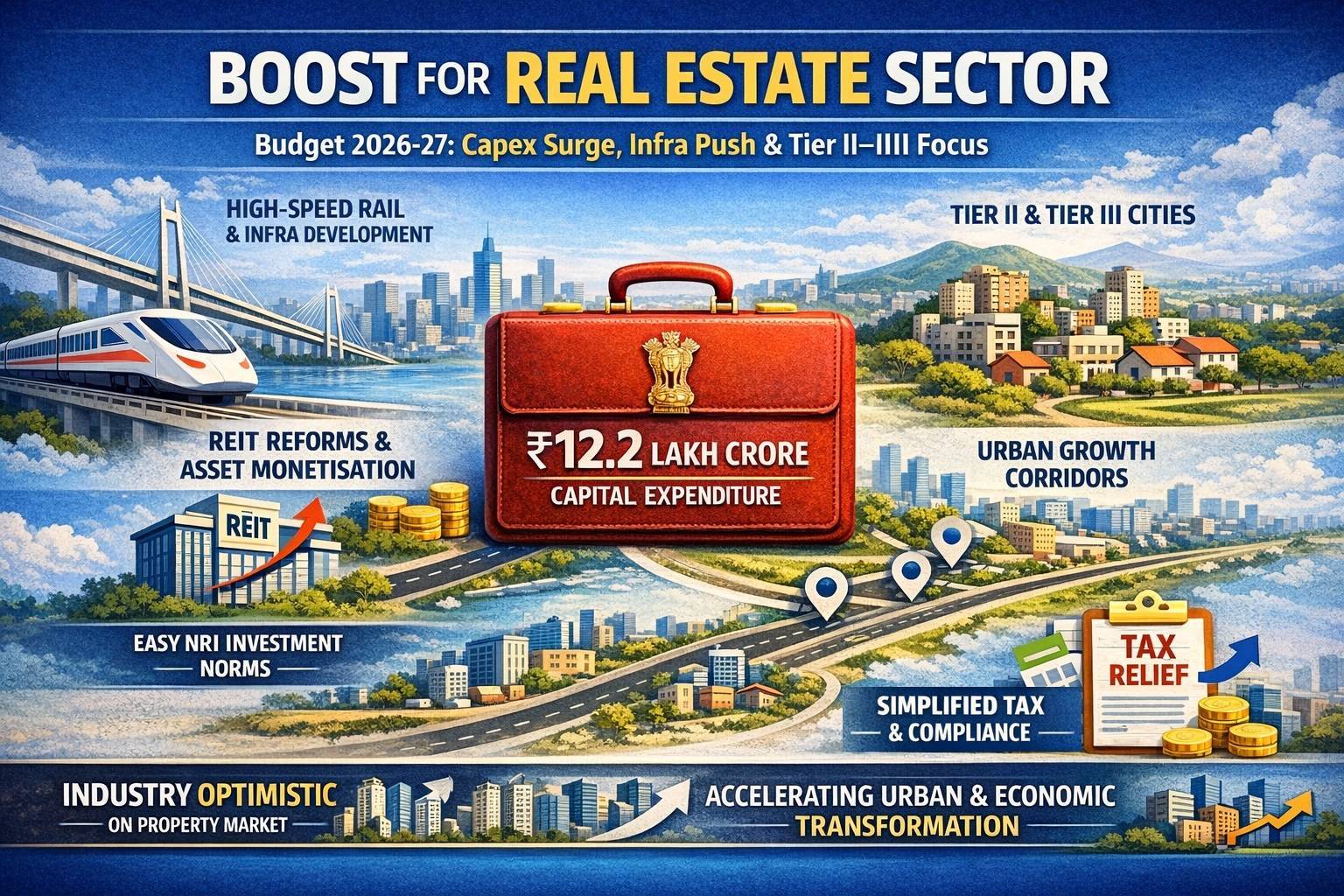

The potential acquisition of Emaar India by Adani Group represents a major shift in India’s real estate landscape. If the deal materializes, it would strengthen Adani’s presence in urban development, while allowing Emaar to exit the Indian market. With growing investments in infrastructure and real estate, Adani Group is positioning itself as a leading force in India’s urban transformation.

As discussions progress, the real estate sector will be watching closely to see how this deal unfolds and what impact it will have on India’s commercial and residential real estate markets.

Image source- Facebook

.png)